Spooky Stablecoins

FATF Guidance, SEC vs CFTC, and the President's Working Group on Financial Markets' Stablecoin Report

It’s been a busy week in crypto policy and politics. Keep reading to get caught up, but one thing is clear (if it wasn’t already): both international and domestic regulators are focused on crypto.

However, the week’s major story lines detailed below share a theme: Congress has a role in deciding how crypto-related policy is handled in the United States. As we experienced with the Infrastructure Bill fiasco, impactful legislation can be snuck under our noses at any time. That’s why we need HODLpac.

For the average citizen, the clearest path to have a say in the regulatory and policy-making process is to engage with our representatives in Congress. It’s time for the US crypto community to organize ourselves and speak as one with our votes and our dollars (and, of course, cryptoassets).

For the new subscribers, three things you can do to get involved with HODLpac:

Subscribe and share our newsletter with your friends and colleagues

Join our Discord to help shape the future of HODLpac:

Donate to HODLpac, get governance tokens, and be a part of the first political DAO in history:

The Week in Crypto Policy

Coverage of the major story lines from the past week in crypto-related policy and politics:

Financial Action Task Force Guidance

On October 28th, the FATF - an inter-governmental body focused on coordinating policy related to anti-money laundering and counter-terrorist financing - released its latest report on “virtual assets” and “virtual asset service providers.”

As usual, the lawyers and policy folks on crypto Twitter unpacked the report and its implications. Jake Chervinsky did us all a favor and created a fantastic thread of threads:

As Jake mentions in the tweet above, FATF released a draft of this most recent report in March/April for public feedback.

The response from the crypto industry was forceful, arguing that FATF’s recommendations would effectively outlaw decentralized finance and hamper the development of crypto technology. Check out the following from March/April 2021:

“FATF Must Consider New Approach to Accomplish AML/CFT Goals,” Blockchain Association

“FATF Takes A Big Shot,” TRM Labs

“Comments to the Financial Action Task Force on the March 2021 Draft Guidance,” Coin Center

So what about this latest (non-draft) guidance?

The consensus is that, while there improvements on the edges, DeFi is still under threat (if this guidance were to translate into law in FATF member countries).

Specifically, the latest FATF guidance lacks a coherent treatment of several kinds of participants in the decentralized finance ecosystem, including: protocol developers, wallet providers, and governance token holders.

Recommended reading:

“The good, bad, and ugly of the FATF crypto guidance,” Peter Van Valkenburgh, Coin Center

“Response to FATF Guidance,” Blockchain Association

“DeFi: A Path Forward,” Lewis Cohen and Alex Lipton, IFLR

SEC vs CFTC

Financial regulation in the United States is administered by an alphabet soup of different agencies and departments.

Some cryptoeconomy stakeholders, like Coinbase, think we should dedicate one regulatory agency to cover “digital assets.” But, for now, since crypto technology touches and challenges so many existing areas of the law, multiple regulators want their say.

One storyline to watch is the jockeying for position between the SEC and the CFTC for authority over certain kinds of cryptoassets and markets.

Some resources to get caught up on the situation:

“CFTC and SEC Are Vying for Crypto Regulation Control,” Jeff Benson, Decrypt

Stablecoins Report

First things first, a good reminder from everyone’s favorite DC insider anon account:

And, everyone’s favorite DC insider non-anon account:

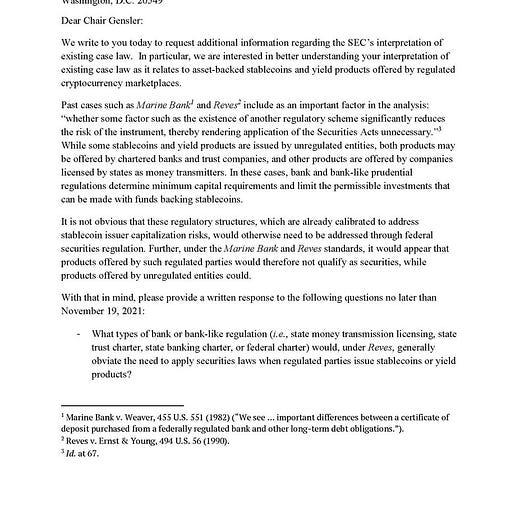

Yesterday, on November 1st, a long-awaited report on stablecoins from the President’s Working Group on Financial Markets was released.

The report acknolwedges stablecoins as an impactful financial innovation that, in the future “may be widely used by households and businesses as a means of payment” and, thus, have implications for the finanical

It also - as mentioned in this newsletter’s intro - acknowledges that financial regulators (the aforementioned alphabet soup) lack the authority to implement all of its recommendations and, therefore, Congress has a role to weigh in.

To address prudential risks associated with the use of stablecoins as a means of payment, the agencies recommend that Congress act promptly to ensure that payment stablecoins are subject to appropriate federal prudential oversight on a consistent and comprehensive basis.

More resources:

🐦 Tweets

📚 Good Reads

“Crypto Dad: ‘Money Is Too Important To Be Left To Central Bankers’,” Steve Erlich, Forbes

“The great American cryptocurrency opportunity,” Rep. Ted Budd, Washington Times

“A Crypto Whisperer on How Regulators Toss Retail Into the Deep End,” Will Gottsegen, CoinDesk

“America’s Crypto Conundrum,” Justin Muzinich, Foreign Affairs

“The geopolitics of money is shifting up a gear,” The Economist

“Context on stablecoin regulation,” FTX Research

“Miners Are The Optimal Buyers: The Data Behind Bitcoin-Led Decarbonization In Texas,” Nic Carter and Shaun Connell, Bitcoin Magazine

🎙️ Listen/Watch

“The Infrastructure Bill - Part 2,” Jerry Brito, Peter Van Valkenburgh, and Robin Weisman, Coin Center’s Tangents Podcast

“Digital Currency: Public or Private?,” Chris Giancarlo, Dante Disparte, and George Selgin, Cato Institute Center for Monetary and Financial Alternatives

What’d we miss? Join our Discord and help curate this newsletter!

Disclaimer: HODLpac is FEC-registered hybrid political action committee and is not legally affiliated with any party, party committee, candidate or candidate committee.